Culti Milano – это итальянский бренд, который символизирует роскошь, качество и богатство аромата.

Процесс ремонта жилья может показаться сложным и запутанным, но с правильным планированием и организацией

Консоль - это вид мебели, который представляет собой столик или полку, чаще всего прикрепленный

Итальянская компания Italamp является одним из ведущих производителей светильников, предлагая широкий ассортимент продукции, которая

В мире современного дизайна мебели керамогранит стал ярким и инновационным материалом, который преображает наше

Неоклассический стиль в интерьере – это гармоничное сочетание классики и современности, которое приобретает все

В наши дни все больше внимания уделяется экологии и устойчивому развитию. Этот тренд активно

Кухня и ванная комната предъявляют особые требования из-за постоянной влажности и возможности разлива воды.

Выбор между кухнями из МДФ и кухонными гарнитурами из ЛДСП зависит от ваших предпочтений,

Наиболее экологичным по праву считается натуральное дерево. Но высокая стоимость сырья, трудоемкость работ и

Дверь для кухни не только декоративный, но и защитный элемент, который помогает защитить другие

Главное - универсальность. Если мебель П-образной или островной конфигурации, то она требует достаточного свободного

Конструкции универсальны, подходят для монтажа на крышах, желобах, водосточных трубах любого типа. Совместимы с

Выращивание цинииЗдравствуйте, уважаемые читатели Посоветуем!Сегодня на страницах блога хочется рассказать Вам ещё об одном

Традесканция – одно из самых красивых садовых растений, которое цветет с мая по сентябрь.

Советы дизайнеров как высадить кустарники для дачи. Спирея, чубушник, шренка, гордона. Калина – красивый

Хвойные растения — украшения любого сада. Они хороши и сами по себе, и в

Варианты укладки тротуарной плитки, а также фото конкретных примеров Вы найдете в этой статье.

Модные и современные коврики спицами для дома и дачи. Мы собрали отличную подборку ковров

Как приклеить витражную пленку на окно? Витражная пленка Просмотров: 2269 Комментарии: Комментарии к записи

Из каких материалов изготавливаются входные металлические двери и как их правильно устанавливать | Интернет-журнал

Подборка лучших мастер-классов по плетению деревьев из бисера для начинающих своими руками. Легкие схемы

Можно затратить значительно меньше средств, но чуть больше усилий, если знать, как упаковать подарок

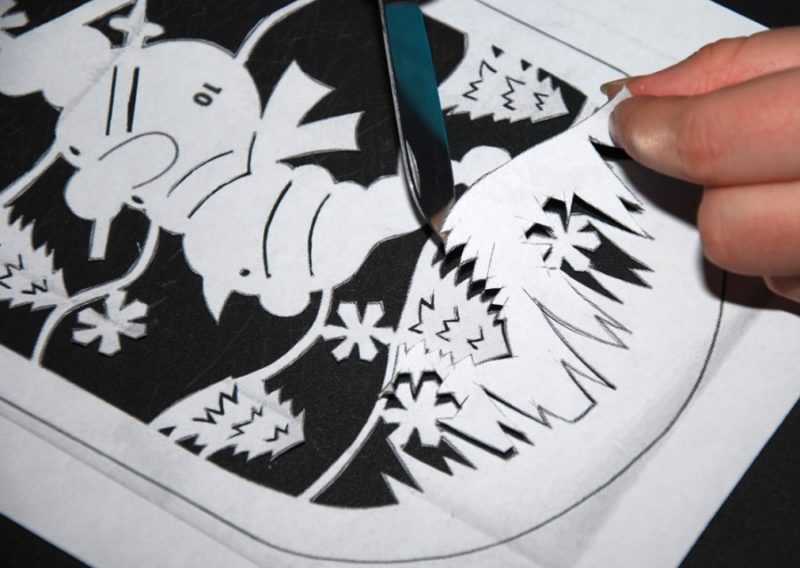

Снежинки - нейтральная тема, которая подходит всем. Объемные снежинки из бумаги – замечательные идеи

Новогодние украшения своими руками: ☝Свежие идеи, фото, пошаговый мастер-класс по изготовлению оригинальных поделок и

Идеи новогоднего декора своими руками, которые сможет сделать каждый! Украшайте дома и квартиры с